What we do

Digitize Communities

Digitize village community savings and lending processes, from group KYC (members information) to process and procedures undertaken by groups

Data Collection

Optimize data science to provide accurate analysis and predictions that will help users create a solid financial footprint.

Value Addition

Integrate value addition services and products for the groups/members to access including financial management knowledge, micro insurance products and capacity building.

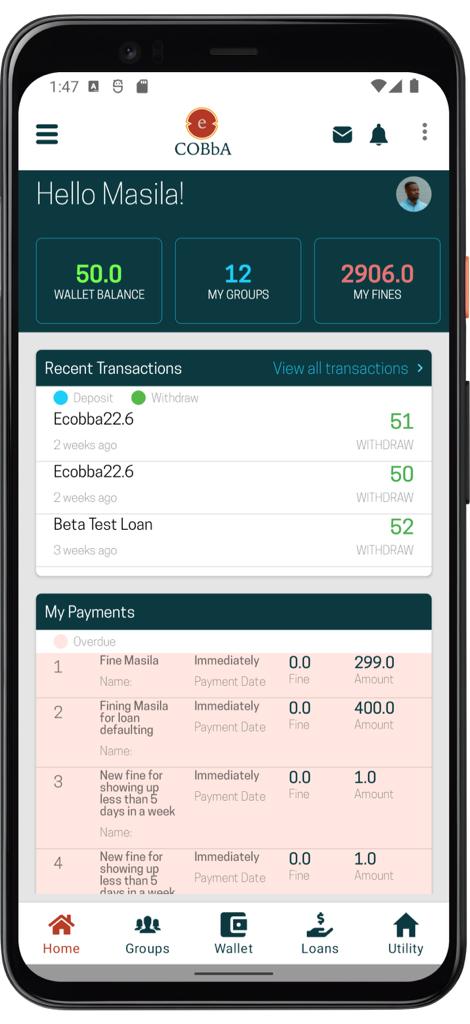

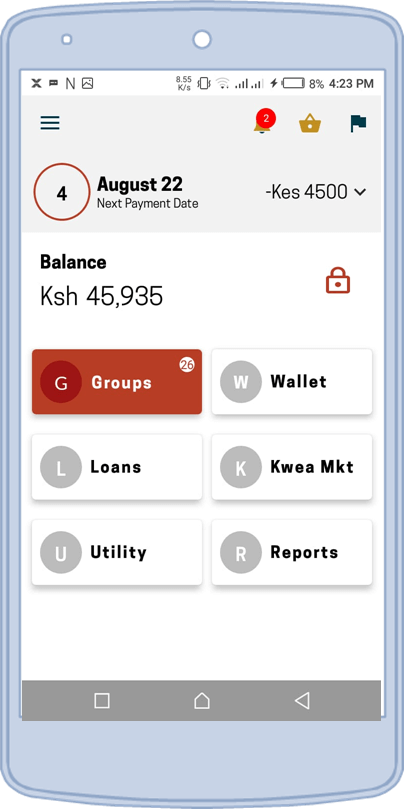

Ecobba is a platform built to support all kinds of savings and investment groups, from SACCOS organizations to informal community societies like Chamas, ViCoBa, Stokvels and the likes, eCOBbA understands your needs

Irene Kiwia -Founder,Ecobba.

How to sign up on Ecobba

Begin access to micro-financial products like savings, loans and insurance, and use data-driven science to give access to more products through credit scoring and profiling, grow your ecosystems, expand products and services and create wealth.

Why we do it

To drive industrilization via saving groups

The features you will love

eCOBbA is FOR EVERYONE!

1. A saving group with few members

2. A big SACCO with hundreds/thousands of members

3. An association or cooperative with various groups

4. An institution like a bank or microfinance with various members

A safe and convenient way for group saving and investment!Market Place

Convenient practical marketplace for community groups, micro-finances, Agri-trade associations, SME associations, lenders, cooperatives, saving schemes to optimize their accessibility and growth

Join Ecobba and start the journey in building a digital financial footprint

Frequently Asked Question

Ecobba stands for online community-based banks.

To drive industrialization via the informal sector in community-saving groups.

If you're logged out and you forget your password, you'll need to reset it. To do this

1.Click on forgot password

2. And click the send password reset link

Please email us at support@ecobba.com and we will help you regain access to your account.

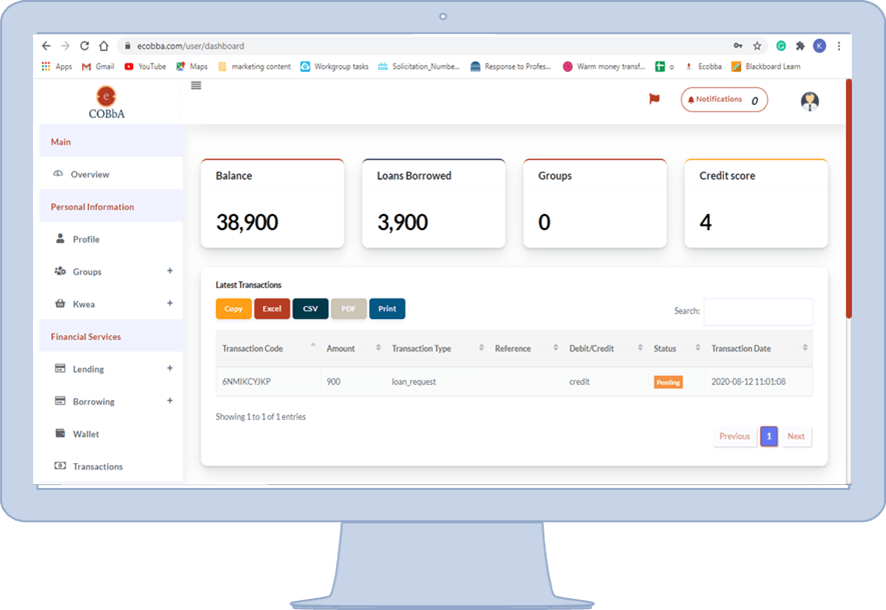

Once you’ve logged in and taken to the dashboard

1.Click on Profile

2.Click on the edit profile button

3. Then you update your “new email”

4.And then save it by clicking on the Update profile button